FIRST VALLEY MORTGAGE

Serving Our Community

Since 1990

Button

Serving The Greater Los Angeles

Serving The Greater Los Angeles Area

Button

Serving The Antelope Valley

Serving The Antelope Valley Area

Button

Serving San Fernando Valley

Serving The San Fernando Area

Button

Our certifications, experience and knowledge

are focused on achieving the highest levels of success for our clients.

All the services you need, in one place!

We offer a wide range of services to meet every type of Real Estate and Home Mortgage needs.

Find the best choice for you

and your family

-

First Time Buyers

First Time BuyersWrite a description

-

Cash-Out Refinance

Cash-Out RefinanceWrite a description

-

No Cash-Out Refinance

No Cash-Out RefinanceWrite a description

-

Investment

Investment

Our Aims

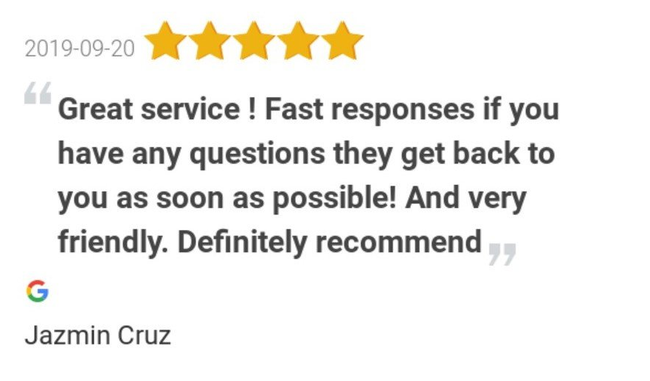

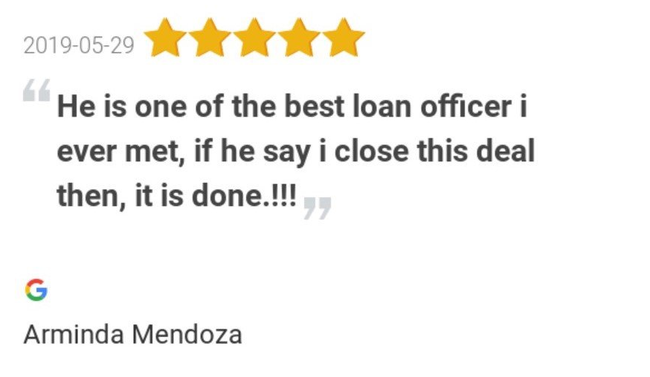

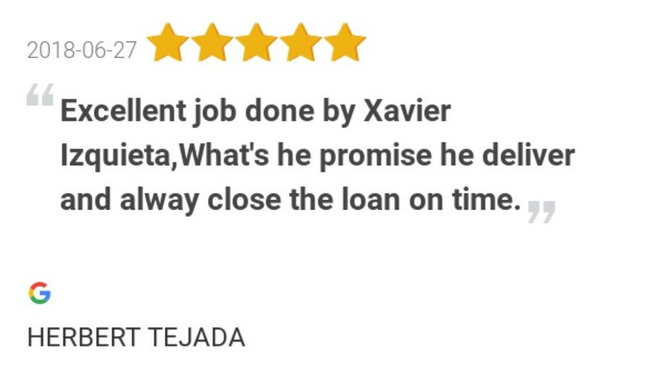

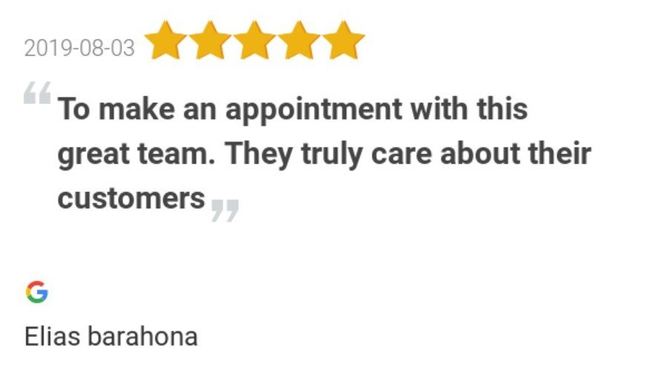

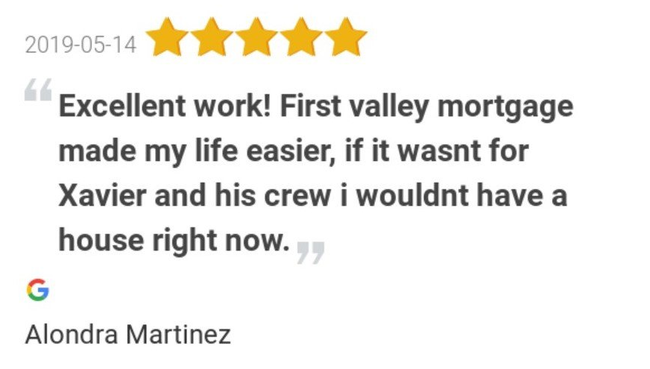

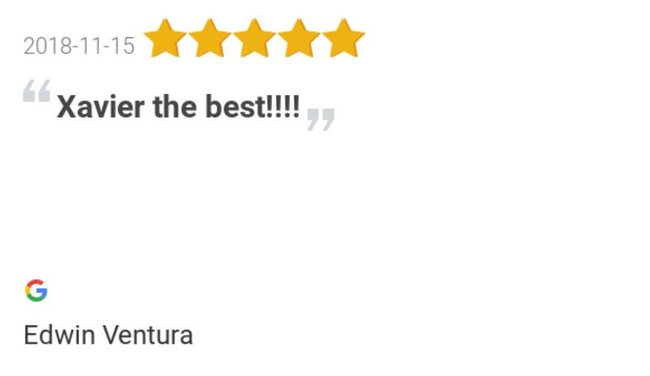

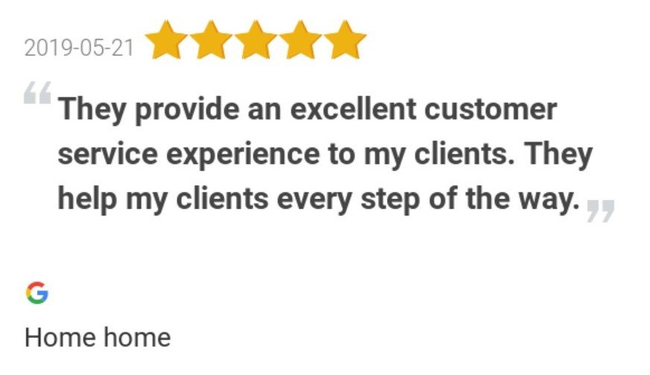

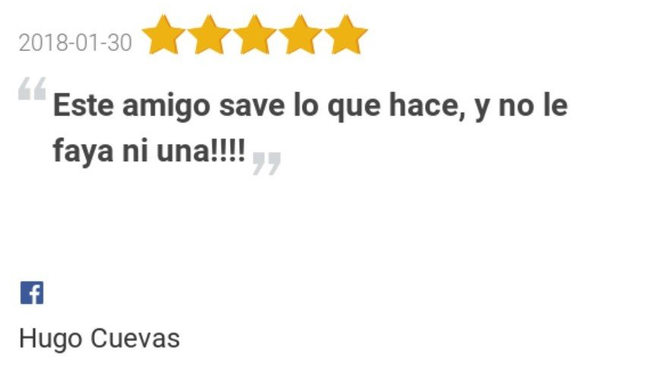

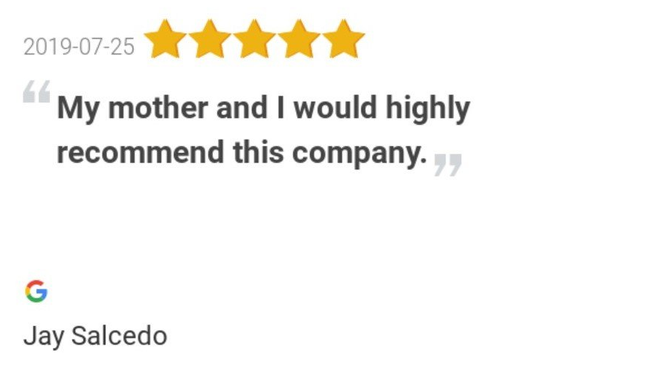

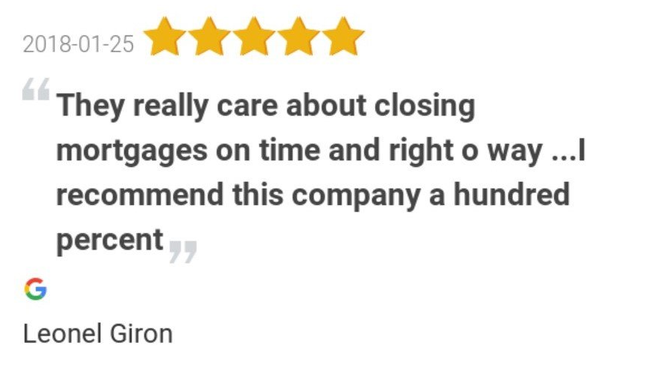

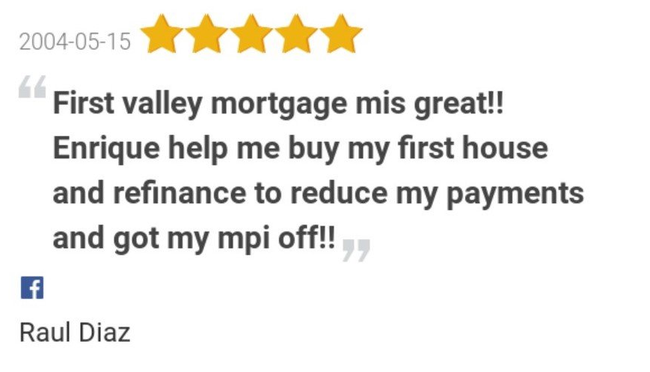

Quotes from Real Customers!

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Interested in our services? We’re here to help!

Contact us, we can provide the perfect solution

for you and your family

14663 Titus St Suite 201,

Panorama City CA 91402

Business Hours

- Monday

- Open 24 Hours

- Tue - Fri

- -

- Saturday

- Appointment Only

- Sunday

- Closed

Office: 818-989-0543

Off Hours Line: 818-652-5841

Fax : 818-286-9542

Email: info@firstvalleyonline.com

Need a Real Estate Agent?

We can refer you!

We want to know your needs so that we can provide the perfect solution.

Contact Us and we’ll do our best to help.

First Valley Mortgage Co. Inc

NLMS# 328920 BRE# 01073956

Copyright © All Rights Reserved.